|

|

Canadian Securities Exchange (CSE), formerly the Canadian National Stock Exchange (CNSX), is an alternative stock exchange in Canada. It was the first stock market approved by the Ontario Securities Commission in the past 70 years. The CSE offers simplified reporting requirements and reduced barriers to the listing. It is an alternative for micro-cap and emerging companies. It had been known as CNQ until the organization re-branded itself in November 2008. It is fully automated rather than the traditional 'open outcry' physical trading floor system. The CSE is located in Toronto, Ontario, and maintains a branch office in Vancouver, British Columbia.

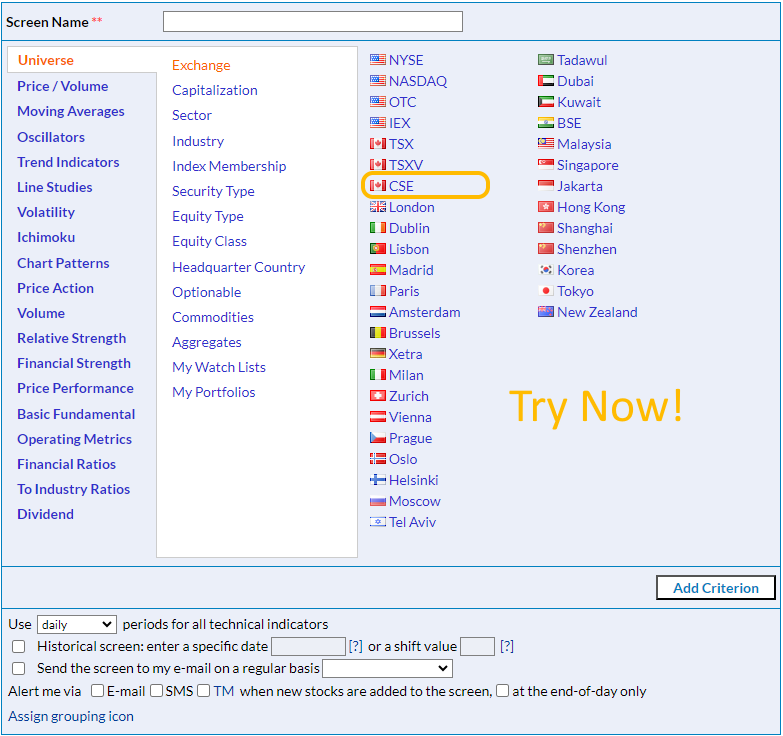

MarketInOut.com suggests the most comprehensive and powerful Canadian Securities Exchange Stock Screener tool for finding outperforming canadian securities exchange stocks. Canadian Securities Exchange Stock Screener provides a wide variety of technical and fundamental criteria to screen stocks by.

The main advantage over competitor Canadian Securities Exchange Stock Screeners is that it also allows backtesting developed stock screening strategy. Backtester Tool allows discover how your screening strategy would be successful if you used it in the past. It is possible to specify criteria for closing a position, stop-loss, take-profit, etc. Then the trading simulator performs all trades in test mode based on the criteria and position maintenance rules. As a result, it provides a detailed report with key metrics, including profit, maximum drawdown, profit factor, mathematical expectation of a win, etc. Having this result enables a trader to optimize the trading strategy further.

In addition to the stock screening core functionality, MarketInOut.com also suggests the Trade Alert feature. Specify any stock and technical signal or price value, and then you only need to wait for the e-mail alert. Try other useful features: Stock Chart, Stock Correlation, Forex Correlation.

|

|

|

International Stock Screeners

|

|

|

| |