|

ETF (exchange-traded funds) offer remarkable investment opportunities. The worldwide ETF asset stands at a

staggering $1.278 trillion.

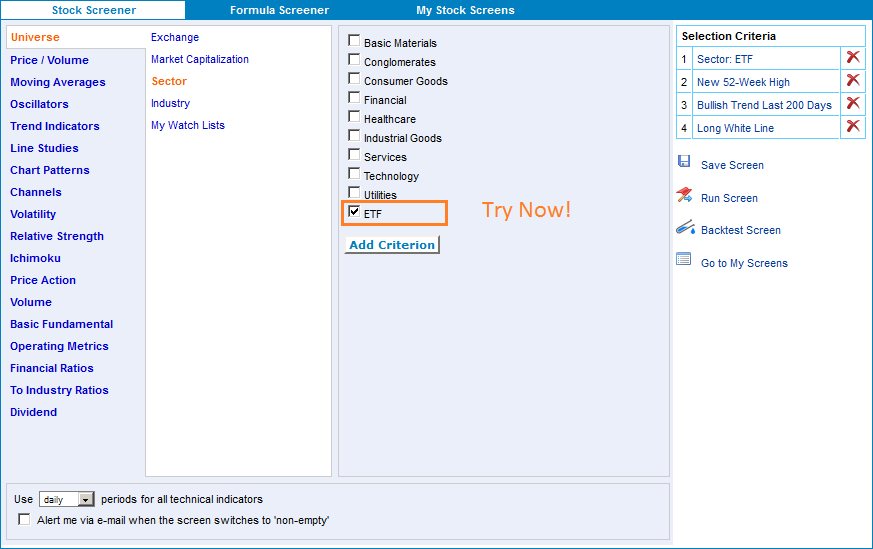

A quality that all successful ETF investors share is the smart use of technology. When it comes to finding the best exchange-traded

funds, the MarketInOut.com Stock Screener provides a powerful ETF screener that helps you do that.

With a click of a button you can set ETF as criteria and view data filtered for exchange-traded funds.

It has an array of features that help you monitor the international ETF scene and find the best investment opportunities.

It's not a coincidence that tech industries are doing so well. You need technology on your side if you want to succeed with ETF,

just like in many other areas.

MarketInOut's ETF screener is a user-friendly software. Of all the sophistication and complexities of the trading

world that it processes, the stock screener makes it quite simple for users to leverage the tools for successful ETF trading.

As a powerful and simple-to-use ETF screener, the MarketInOut Stock Screener makes you a much better investor.

The numerous features of the Stock Screener such as Watch list, Price/volume, Moving Averages, Patterns, Trends Indicators,

Financial Ratios and Volatility combine to give you a sharp trading insight. As you use the ETF screener to focus on

exchange-traded funds, all these features help you better understand the ETF market.

Based on the better understanding of the ETF markets, you will be able to make better decisions.

Functioning as a reliable ETF screener, MarketInOut's software helps minimize risks.

The Backtester feature for instance, lets you see what results your ETF screening strategy would have produced.

Screening strategy is a very important element of success with exchange-traded funds and MarketInOut's ETF screener

helps you fine tune a winning strategy.

All of the above, and more, comes down to maximizing your ROI. The MarketInOut Stock Screener is a well thought-out,

advanced and user-friendly software designed to help you be a smarter and more successful ETF investor.

|